There is deadweight loss associated with the profit-maximizing output. – Profit maximization is a central concept in microeconomics, yet it can lead to an unintended consequence: deadweight loss. This loss arises when the profit-maximizing output of a firm falls short of the socially optimal output, resulting in a misallocation of resources and a reduction in economic efficiency.

This phenomenon has significant implications for market economies, affecting consumer welfare, producer profits, and overall economic growth. Understanding the causes, consequences, and policy implications of deadweight loss is crucial for policymakers and economists seeking to promote efficient and equitable markets.

1. Defining Deadweight Loss

Deadweight loss is a measure of the economic inefficiency caused by market interventions that prevent the allocation of resources to their most productive use. It occurs when the quantity of a good or service produced and consumed is below or above the socially optimal level.

In a market economy, deadweight loss can occur due to various factors, such as price controls, taxes, subsidies, or other government regulations that distort market prices and incentives.

2. Profit-Maximizing Output: There Is Deadweight Loss Associated With The Profit-maximizing Output.

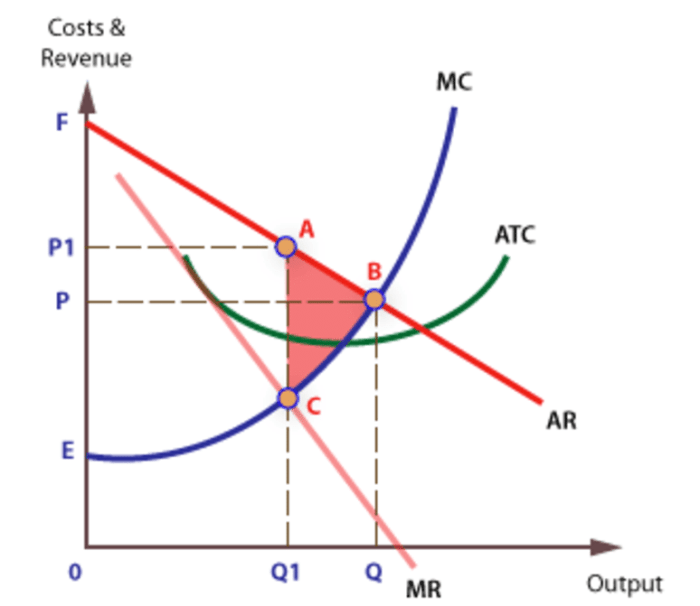

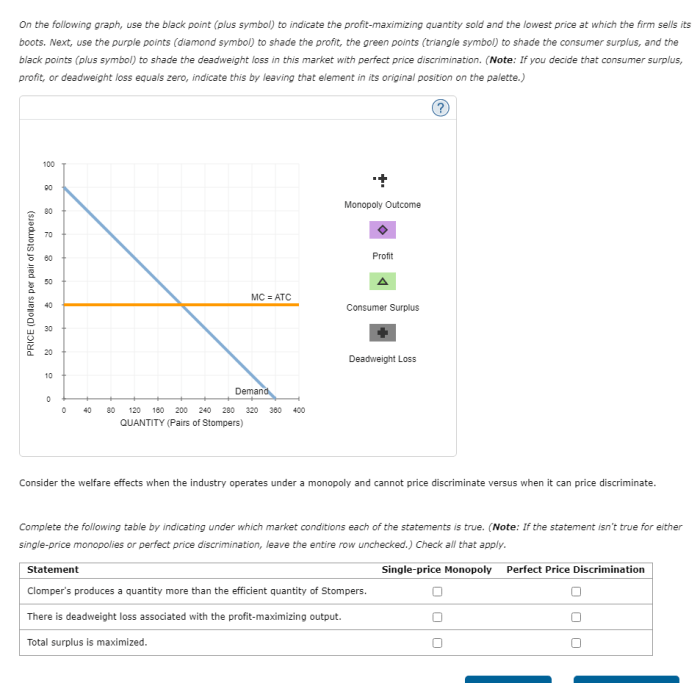

Profit-maximizing output is the quantity of a good or service that a firm produces at which it earns the maximum profit. A firm determines its profit-maximizing output level by comparing the marginal cost (MC) and marginal revenue (MR) of producing additional units.

When MC equals MR, the firm is at its profit-maximizing output level. At this point, the firm is producing the quantity of output that generates the highest profit.

3. Deadweight Loss and Profit Maximization

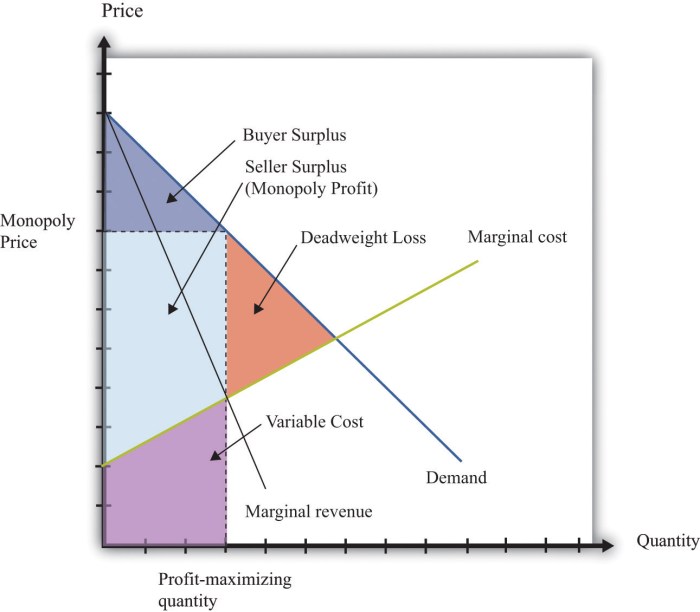

Profit maximization can lead to deadweight loss when the market price of a good or service is above or below the socially optimal price.

When the market price is above the socially optimal price, firms produce less output than the socially optimal level. This results in a loss of consumer surplus and a deadweight loss to society.

Conversely, when the market price is below the socially optimal price, firms produce more output than the socially optimal level. This results in a loss of producer surplus and a deadweight loss to society.

4. Causes of Deadweight Loss

Several factors can contribute to deadweight loss in a market, including:

- Price controls: Government-imposed price ceilings or price floors can create deadweight loss by preventing the market from reaching the socially optimal price.

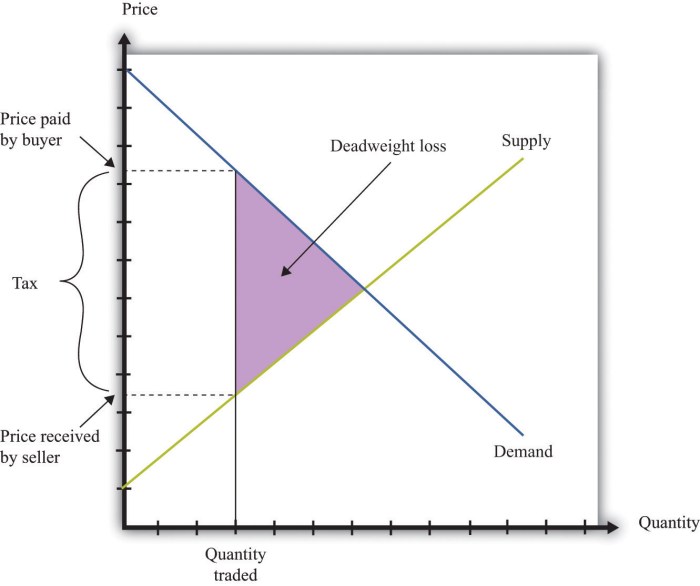

- Taxes: Taxes on goods or services can lead to deadweight loss by increasing the cost of production and reducing the quantity produced and consumed.

- Subsidies: Government subsidies can create deadweight loss by artificially lowering the cost of production and encouraging firms to produce more output than the socially optimal level.

Questions and Answers

What is deadweight loss?

Deadweight loss is a measure of the economic inefficiency caused by market distortions, such as price controls or taxes, that prevent the market from reaching its equilibrium.

How does profit maximization contribute to deadweight loss?

When firms maximize their profits, they may produce less output than the socially optimal level, as they prioritize their own profits over consumer welfare.

What are the consequences of deadweight loss?

Deadweight loss reduces economic efficiency, lowers consumer surplus, and decreases producer profits, leading to a misallocation of resources and a reduction in overall economic growth.